As entrepreneurs embark on their journey to bring their innovative ideas to life, one crucial aspect of their startup’s success lies in their ability to effectively pitch their business to potential investors and stakeholders. However, despite having groundbreaking concepts and a strong passion for their ventures, many founders often make common mistakes while pitching that can hinder their chances of securing funding and support. Understanding these pitfalls can significantly enhance their pitch and increase the likelihood of attracting investors.

One prevalent mistake that founders make is failing to clearly articulate their business concept and value proposition. Investors need to grasp the core essence of a startup quickly, so founders must concisely communicate what problem their product or service solves, who their target market is, and what sets their solution apart from competitors. A lack of clarity or rambling explanations can confuse investors and lead them to lose interest. Therefore, founders must craft a clear and compelling narrative that highlights the uniqueness and market potential of their venture.

Moreover, founders often underestimate the importance of demonstrating a deep understanding of their target market and industry landscape. Investors are keen to assess whether founders have thoroughly researched their market, identified their competitors, and validated the demand for their solution. Neglecting to showcase this knowledge can raise doubts about the founders’ preparedness and the credibility of their business model. By conducting comprehensive market research and incorporating relevant data and insights into their pitch, founders can instill confidence in investors and build a more robust case for investment.

Another critical aspect that founders sometimes overlook is the significance of showcasing a scalable and sustainable business model. Investors seek ventures that exhibit a clear path to profitability and long-term growth. Founders must outline their revenue streams, pricing strategy, customer acquisition plan, and projected financials to demonstrate the viability and sustainability of their business. Failing to provide a convincing monetization strategy or neglecting to address key financial metrics can raise red flags for investors and undermine the credibility of the pitch.

Furthermore, founders often make the mistake of focusing too much on the features of their product or service rather than emphasizing the benefits and outcomes it offers to customers. While detailing the functionality and technology behind their solution is essential, founders should also highlight the value it delivers to users and how it addresses a pressing need or pain point. By framing their pitch around the value proposition and customer benefits, founders can effectively communicate the impact and relevance of their offering, making it more compelling to potential investors.

In addition to content, the delivery of the pitch is also crucial in making a positive impression on investors. Founders need to convey confidence, passion, and authenticity while presenting their business. Engaging storytelling, a strong presence, and the ability to handle questions and feedback effectively can leave a lasting impact on investors and differentiate the pitch from others they encounter. Practicing the pitch, seeking constructive feedback, and refining the presentation can help founders enhance their delivery and ensure they make a memorable impression on investors.

Lastly, founders sometimes fail to address potential risks and challenges associated with their venture in their pitch. Investors are aware that every business faces obstacles and uncertainties, and they appreciate founders who acknowledge and mitigate these risks proactively. By openly discussing potential challenges, competitors, regulatory issues, or market dynamics, founders can demonstrate a realistic understanding of their business environment and showcase their preparedness to navigate hurdles effectively. This transparency can build trust with investors and showcase the founders’ resilience and adaptability in the face of adversity.

In conclusion, while pitching their startups to investors, founders must be mindful of avoiding common mistakes that can undermine the effectiveness of their pitch. By clearly articulating their business concept, showcasing market knowledge, highlighting a scalable business model, emphasizing customer benefits, delivering a confident presentation, and addressing potential risks, founders can significantly enhance their pitch’s impact and increase their chances of securing funding and support. By learning from these common mistakes and incorporating best practices into their pitching strategy, founders can position their ventures for success and attract the investors needed to fuel their growth and innovation.

Piyush Goel: The Man Who Writes Backwards but Thinks Ahead

India – In a world where speed defines success and digital shortcuts…

- Lavanya

- September 12, 2025

KYPTEC® 640 ENC True Wireless Earbuds – The Beat Never Stops

In a world where sound defines moments, the KYPTEC® 640 ENC True…

- Lavanya

- September 11, 2025

Billionaires Mindset Summit 2025 – Indore Emerges as the New Hub of Collaboration, Innovation & Growth

Indore, August 30, 2025 – Indore, the city of entrepreneurs, witnessed a…

- Lavanya

- September 10, 2025

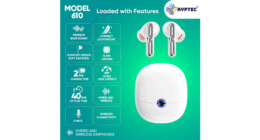

KYPTEC® 610 Hybrid ANC Wireless Ear Buds – The Soundtrack to Your Hustle

In today’s fast-paced world, audio devices are more than a utility—they are…

- Lavanya

- September 10, 2025